Digital Marketing In Insurance Industry: Top 5 Insurance Marketing Hacks

The insurance businesses depend largely on growing their clientele. If you run an insurance business, you understand that the growing customer base is the most challenging part. This is where you need digital marketing to not only attract new customers but also upsell to existing ones. Defining your target audience and ideal customer is a key part of your overall marketing strategy. While baby boomers are getting older, the new generation of customers is tech-savvy. This means you can’t rely on old-fashioned marketing tactics to sell your insurance products to Generation Z which makes up roughly 17.6% of Canada’s total population. So, all of the potential insurance marketing hacks revolve around how prepared you are to serve young customers. Let’s take a look at 5 insurance marketing hacks that can help you achieve tremendous growth:

Table of Contents

1. Focus on data

A data-driven approach is absolutely necessary if you want to make the most of your digital marketing strategies. Data is at the center of a sound insurance marketing strategy that focuses on delivering an improved customer experience. Customer surveys are now so proficient, that for a small investment you can have unique and optimized research in just a few days.

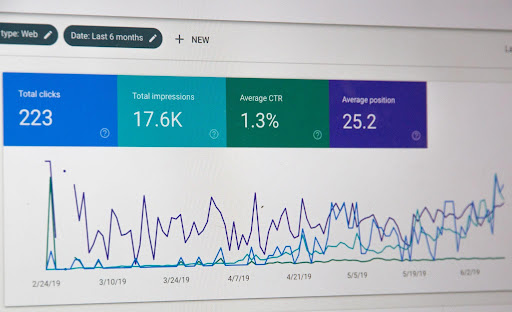

We all know about Google Analytics and other tools that help businesses understand their customers better and earn the highest possible ROI from marketing campaigns. If your current marketing efforts are not data-driven, then it’s time to make some changes. Let innovative insurance marketing tools help you navigate success. Ideally, you should be using insurance marketing tools that are designed particularly for the insurance industry.

2. Implement smart bots

Implementing smart bots is another incredible insurance marketing hack that can completely transform the way you interact with your current and potential customers. If you think a chatbot is nothing more than a little window that pops up when someone visits a website, think again. We’re talking about smart, AI-driven chatbots that are capable of delivering satisfactory customer experiences.

If you run an insurance business, you must consider implementing chatbots. Adweek found out that platforms equipped with chatbot features can boost sales/lead generation, brand awareness, customer support, and marketing engagement. This way you can be ahead of many problems that can happen because of the lack of communication. Make your customer experience proficient and be sure that your site serves as an example of the best practice.

3. Create the digital customer journey

Your digital presence, from your website to paid ads, must be highly organized for the customer journey. It simply means providing your audience with the information they need to make a decision, without delays. In other words, navigation should be based on intuition. Customers shouldn’t struggle to find what they are looking for. For example, if someone wants to know about your insurance products, the relevant information should be readily available. If you are adding more information than needed, then customers will be lost on your site.

To make things simple and clear, create a customer journey map, a visual representation of every digital experience your audience could have. Here are some valuable tips for getting started with a customer journey map:

- Use sales funnel to define the buying process

- Put yourself in your customer’s shoes

- Profile your personas and define their goals

- Make a list of all the touchpoints

- Take the customer journey yourself

4. Create high-quality content

Most insurance users do their research before buying an insurance policy. They seek recommendations and comparisons. Creating high-quality content with great consistency will help your prospective customers find the right solutions. Analytics will make it easier for you to create the information your customers are looking for.

Let your audience know how it likes to work with your agency. Keep your customers informed by publishing rate comparisons for major insurance carriers. Why is it important to keep your customers informed? 78% of consumers say that relevant content increases their purchase intent for a product or service. While you keep creating high-quality content for your audience, don’t forget to track analytics to know which content performs well.

5. Use email marketing the right way

The future of email marketing is likely to be tougher in the future. Nonetheless, you must have a well-thought-out email marketing strategy for your insurance business. The email industry is continuously changing, opening up new avenues for businesses that want to connect with their customers and deliver top-notch customer service. Try out email marketing platforms that are powered by artificial intelligence, personalization, and simplistic designs. PathwayPort is a perfect example of such a platform.

Final Thoughts

Digital marketing has a variety of applications for your insurance agency. Be sure to choose the right platform and technology to implement a powerful marketing strategy. The marketing hacks I just shared are just a few of the many strategies to get your insurance to stand out.